Sustainability

LATEST UPDATES

Sustainability Fundamental Policy

Contribution toward Sustainable Development

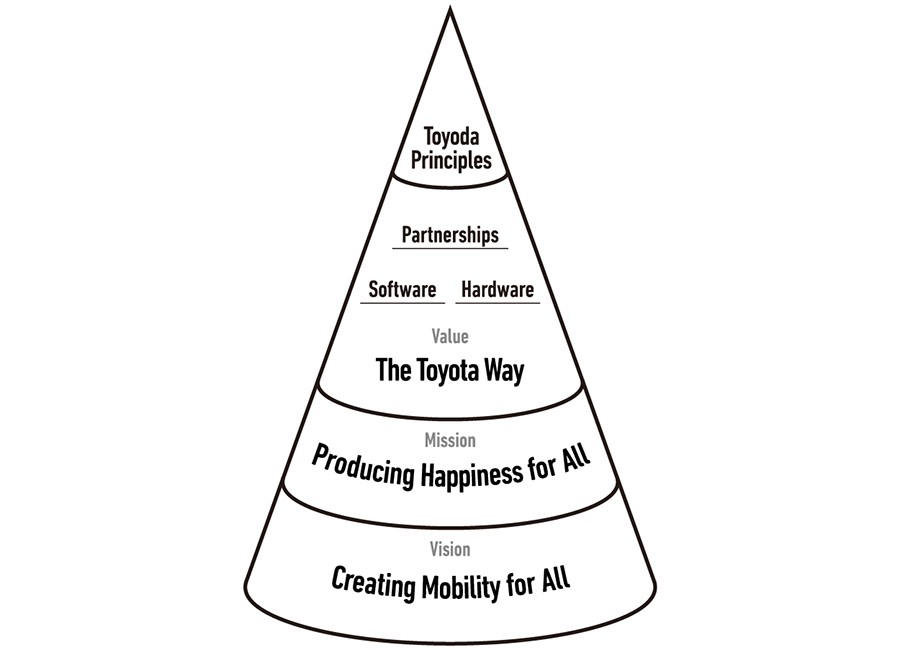

We, Toyota Motor Corporation and our subsidiaries, have inherited the spirit of "Toyoda Principles" since our foundation, and have aimed to create a prosperous society through our business activities, based on "the Guiding Principles at Toyota." In 2020, based on these Principles, we compiled the "Toyota Philosophy" and set the mission of "Producing Happiness for All." We aim to be the "best company in town" that is both loved and trusted by the people.

We will contribute to the sustainable development of our society/planet by promoting sustainability, as we have, under the "Toyota Philosophy," based on the Sustainability Fundamental Policy and individual policies.

Customers

Based on our "Customer First" philosophy, we develop and provide innovative, safe, and outstanding high-quality products and services that meet a wide variety of customer demands to enrich the lives of people around the world. (Guiding Principles: 3 and 4)

We will endeavor to protect the personal information of customers and everyone else we are engaged in business with, in accordance with the letter and spirit of each country and region's privacy laws. (Guiding Principle: 1)

Employees

We respect our employees and believe that the success of our business is led by each individual's creativity and solid teamwork. We support personal growth for our employees. (Guiding Principle: 5)

We support equal employment opportunities and diversity and inclusion for our employees. We do not discriminate against them. (Guiding Principle: 5)

We strive to provide fair working conditions and to maintain a safe and healthy working environment for all our employees. (Guiding Principle: 5)

We respect and honor the human rights of people involved in our business and, in particular, do not use or tolerate any form of forced or child labor. (Guiding Principle: 5)

Through communication and dialogue with our employees, we build and share the value "Mutual Trust and Mutual Responsibility," working together for the success of our employees and the company. We recognize our employees' right to freely associate, or not to associate, complying with the laws of the countries and regions in which we operate. (Guiding Principle: 5)

Management of each company takes leadership in fostering a corporate culture and implementing policies that promote ethical behavior. (Guiding Principles: 1 and 5)

Business Partners

We respect our business partners such as suppliers and dealers and work with them through long-term relationships to realize mutual growth based on mutual trust. (Guiding Principle: 7)

Whenever we seek a new business partner, we are open to any and all candidates, regardless of nationality or scale of the company, and evaluate them based on their overall strengths. (Guiding Principle: 7)

We maintain fair and free competition in accordance with the letter and spirit of each country and region's competition laws. (Guiding Principles: 1 and 7)

Shareholders

We strive to enhance corporate value while achieving stable and long-term growth for the benefit of our shareholders. (Guiding Principle: 6)

We provide our shareholders and investors with timely and fair disclosure on our operating results, financial condition and non-financial information. (Guiding Principles: 1 and 6)

Global Society / Local Communities

Environment

We aim for growth that is in harmony with the environment by seeking to minimize the environmental impact of our business operations, such as by working to reduce the effect of our vehicles and operations on climate change and biodiversity. We strive to develop, establish, and promote technologies that enable the environment and economy to coexist harmoniously, and to build close and cooperative relationships with a wide spectrum of individuals and organizations involved in environmental preservation. (Guiding Principle: 3)

Community

We implement our philosophy of respect for people by honoring the culture, customs, history, and laws of each country and region. (Guiding Principle: 2)

We constantly pursue safer, cleaner, and improved technologies that satisfy the evolving needs of society for sustainable mobility. (Guiding Principles: 3 and 4)

We do not tolerate bribery of or by any business partner, government agency, or public authority, and maintain honest and fair relationships with government agencies and public authorities. (Guiding Principle: 1)

Social Contribution

Wherever we do business, we actively promote and engage, both individually and with partners, in social contribution activities that help strengthen communities and contribute to the enrichment of society. (Guiding Principle: 2)

ReferenceMain sustainability-related individual policies

Toyota Philosophy

Toyota's founding spirit and its signpost in transition to a mobility company.

Topics

Apr. 19, 2024

Toyota Begins Using "Self-sufficient" PET Bottle Recycling for New Land Cruiser "250"

As one approach to establishing a recycling-oriented society, we are promoting the use of recycled materials in car interiors. However, we are facing the challenges of price increases and shortages of PET bottles as a raw material.

Therefore, in a world first, we have started internally collecting PET bottles used by employees to have them reborn as recycled fibers for the new Land Cruiser "250" seat fabric.

By having employees wash, separate, and box the bottles themselves, we not only achieve self-sufficiency in procuring high-quality raw material, but we can also establish a circular system built on close cooperation between partner companies, such as recycling companies and fabric suppliers. Using recycled raw materials will allow us to reduce CO2 emissions by about 10% compared to conventional 100% petroleum-derived raw materials.

We continue to promote various initiatives on the path toward carbon neutrality, including using decarbonization technology for production processes and introducing recycling technology for car part reuse. Now, with the addition of recycled materials, we are changing the future of cars at the material level, as well!

Apr. 02, 2024

Toyota Recognized as a White 500*1 enterprise under the Certified Health & Productivity Management Organization Recognition Program for the Seventh Consecutive Year and as a Sports Yell Company 2024+*2

To produce happiness for all, Toyota is committed to creating an attractive workplace where employees with wide-ranging skills and values can demonstrate their abilities to the fullest. In line with its health-related philosophy and policy,*3 Toyota promotes strategic initiatives in collaboration with each workplace and affiliated company and makes constant improvements by reviewing each measure.

In recognition of these efforts, in March 2024, Toyota was recognized as a White 500 enterprise under the Certified Health & Productivity Management Organization Recognition Program (goal of recognizing over 500 organizations for positive policies), which is jointly implemented by the Ministry of Economy, Trade and Industry and Nippon Kenko Kaigi. This is the seventh consecutive year Toyota has been so recognized.

In addition, as part of its efforts to promote employee health, Toyota is working to provide exercise support to all employees to improve physical fitness and help prevent illness. Toyota was recognized by the Japan Sports Agency as a Sports Yell Company 2024+ for such efforts, which include daily workplace exercise practices, exercise habit awareness-raising through videos and apps, practical skills guidance according to physical fitness, and workplace sports events.

Toyota will continue these efforts to further promote health and productivity management based on the Declaration of Health Commitment by top management. The company recognizes that employees are valuable assets, that the physical and mental health of employees are driving forces behind its good performance, and that happiness for all employees is vital.

| *1 | White 500 https://www.meti.go.jp/policy/mono_info_service/healthcare/kenkoukeiei_yuryouhouzin.html (in Japanese) |

|---|---|

| *2 | Sports Yell Company https://www.mext.go.jp/sports/b_menu/houdou/jsa_00159.html (in Japanese)

|

| *3 | Philosophy and policy for health and safety https://global.toyota/en/sustainability/esg/health-safety/ |

Jan. 29, 2024

Toyota Will Stop Providing Paper Catalogs in Favor of Smart Catalogs From 2025

-

- A meeting using a Smart Catalog

-

- A Toyota dealership no longer using paper catalogs

Toyota will stop providing paper product catalogs in Japan from 2025 and promote the use of Smart Catalogs at Toyota dealerships nationwide.

We have been providing paper product catalogs for many years, but to further promote SDGs and carbon-neutral initiatives, we will stop producing and printing all paper catalogs for Toyota brand vehicles in January 2025.

Paper product catalogs use approximately 7,000 tons of paper annually and not only consume a large amount of forest resources but also create issues in manufacturing, transportation, storage, and disposal. We have been considering solutions. This change is predicted to reduce carbon emissions by approximately 11,000 tons annually (according to TOYOTA CONIQ Alpha, Inc. research).

In addition, we are gradually introducing Smart Catalogs through digital terminals at Toyota dealerships nationwide to offer customers an even more attractive car selection experience. These Smart Catalogs will use high-definition tablets to provide unique digital content, such as easy-to-understand vehicle feature introductions using video and computer graphics and the ability to compare multiple models side-by-side.

PDF versions of web catalogs will continue to be available on the Toyota product website (toyota.jp).

We will continue working to reduce the environmental impact of our entire supply chain, including at sales sites, and contribute to achieving carbon neutrality.

Dec. 06, 2023

Toyota awarded the Gold Prize in PRIDE INDEX 2023*

Toyota was awarded the Gold Prize in PRIDE INDEX for the third year in a row, presented by "work with Pride", one of the volunteer associations supporting the facilitation and establishment of diversity management of sexual minorities such as LGBTQ+.

We consider diversity, equity, and inclusion to be a key element of our business infrastructure and are working to create a welcoming workplace where employees with diverse skills and values, regardless of gender, age, nationality, race, ethnicity, creed, religion, sexual orientation, gender identity, disability, marital or family status, can demonstrate their abilities to the fullest and achieve self-fulfillment.

| * |

What is the "PRIDE INDEX" The index evaluates initiatives and awards three levels (Gold, Silver, Bronze) according to an overall score based on the following five indicators.

|

|---|

Oct. 19, 2023

The Toyota Automobile Museum Holds a Series of SDG Exhibitions

-

- 2021 Exhibition

-

- 2023 Exhibition (featuring the solar-powered Toyota RaRa II)

The Toyota Automobile Museum―established in 1989 by Toyota Motor Corporation to help build a prosperous future for both people and vehicles―considers the constant pursuit of sustainability a critical part of its mission. To further this cause, the museum introduced an exhibition series on Sustainable Development Goals (SDGs) in 2021 titled "Let's Think About SDGs in Toyota Automobile Museum."

The inaugural exhibition gave an overview of SDGs, with the subsequent exhibition focused on carbon neutrality. The last of these, which started on August 1, 2023, and will continue until January 14, 2024, features various low-carbon vehicles powered by solar energy, electricity, biodiesel, and so on.

The idea behind these exhibitions is to accurately inform young people and children about the current state of society in general as well as problems closer to home, prompting them to take actions that contribute to a better future. In the activity area, many visitors―including families with small children―have taken the time to fill out a questionnaire and share what they are doing to help achieve the SDGs.

Staying true to its founding spirit, the Toyota Automobile Museum will keep contributing to a sustainable future.

Let's Think About SDGs in Toyota Automobile Museum 2021 2022 2023

Oct. 19, 2023

Toyota has obtained "Shizen Kyosei Site"*1 certification from the Ministry of the Environment for contributing to the expansion of biodiversity conservation areas

As part of the Challenge to Establish a Future Society in Harmony with Nature, Toyota has been collaborating with diverse individuals in society to expand the circle of nature conservation and other activities promoting coexistence with nature from local communities to a global scale.

In December 2022, the 15th Conference of the Parties to the Convention on Biological Diversity (COP15) adopted the Kunming-Montreal Biodiversity Framework with the common global goal to "halt and reverse biodiversity loss to put nature on a recovery track by 2030."

To achieve this goal, targets such as 30by30 have been established within this framework for each country to conserve 30% or more of their terrestrial and marine areas.

Toyota has joined the 30by30 Alliance for Biodiversity*2 to contribute to the achievement of the 30by30 goal in Japan through its ongoing efforts for nature conservation at various facilities. The four sites, namely Toyota Technical Center Shimoyama, Biotope Tsutsumi, Forest of Toyota, and Toyota Mie Miyagawa Forest, obtained certification as Shizen Kyosei Sites from the Ministry of the Environment in October 2023.

These sites will be registered in the World Database as OECMs*2.

We will continue to make the most of the technology and expertise we have accumulated through various businesses, aiming to achieve a sustainable society where humans and nature can coexist.

| *1 |

|

|---|---|

| *2 | Shizen Kyosei | 30by30 (Ministry of Environment) https://policies.env.go.jp/nature/biodiversity/30by30alliance/documents/3030emap.pdf |

| Name of the Sites | Location | Area | Overview of the Site |

|---|---|---|---|

| Toyota Technical Center Shimoyama | Toyota City, Okazaki City, Aichi Pref. | 385 ha | Conduct forest thinning, paddy field cultivation, and grass mowing to maintain the Satoyama environment adjacent to the R&D center. |

| Biotope Tsutsumi | Toyota City, Aichi Pref. | 0.74 ha | Establish a biotope within the production site to contribute to the conservation of the local native ecosystem. |

| Forest of Toyota | Toyota City, Aichi Pref. | 45 ha | Conserve the Satoyama environment and utilize it as a place for maintenance, research, and community-oriented education. |

| Toyota Mie Miyagawa Forest | Taki County, Mie Pref. | 1689.53 ha | Promote sound forest management based on forest resource information and establish a healthy forest that can fulfill public functions. |

-

-

- Toyota Technical Center Shimoyama

- A view of the forest and paddy fields

-

-

-

- Biotope Tsutsumi

- Panoramic view of the biotope

-

-

-

- Forest of Toyota

- A rare species of star magnolia identified on the site (Ministry of the Environment Red List 2020: Near Threatened)

-

-

-

- Toyota Mie Miyagawa Forest

- A view of the forest after thinning

-